QuickBooks: Fine for One Hotel, Frustrating for Many

For small businesses, QuickBooks is a household name. Many hoteliers start here. But as portfolios grow, the cracks show. QuickBooks was never designed for multi-property hotel management.

The Limits of QuickBooks for Hotel Portfolios

- No USALI compliance: Financials don’t align with industry standards.

- Manual rollups: Consolidating multiple properties means endless spreadsheets.

- Siloed budgeting: No integrated budgeting or forecasting tied to accounting.

- Limited visibility: CFOs can’t see portfolio-wide performance in real time.

The result: wasted hours, inconsistent data, and limited insights at the corporate level.

Why Hotel-Specific Accounting Software Matters

Hotel management companies need systems built with their reality in mind. That means:

- USALI-compliant chart of accounts.

- Portfolio-wide reporting in seconds.

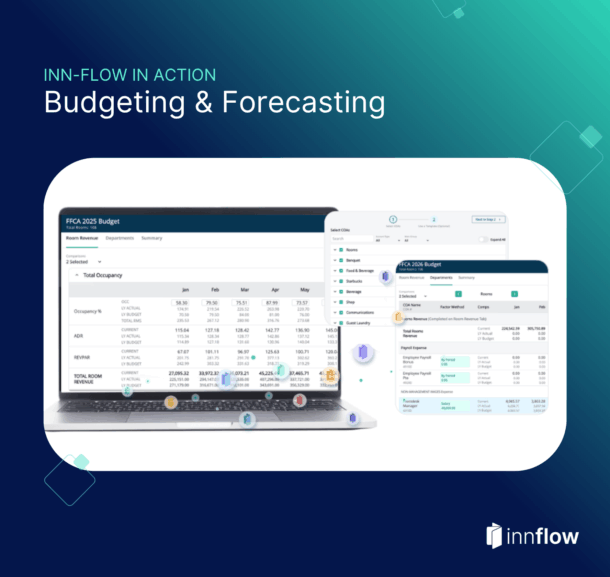

- Integrated budgeting and forecasting.

- Labor, payroll, and facilities connected with accounting.

Inn-Flow was built by hoteliers, for hoteliers — solving the problems QuickBooks can’t.

How Inn-Flow Makes the Switch Simple

Switching systems doesn’t have to be painful. With Inn-Flow:

- Implementation is measured in weeks, not months.

- No hidden fees, no steep learning curve.

- Property teams can adopt quickly, while corporate gains clarity across the portfolio.

Download our guide: Switching from QuickBooks to Inn-Flow.